Workshop on Technology-based Business Models in Support of Financial Inclusion in Vietnam

On December 15, 2017, with the support of ADA and SECO, VMFWG, together with SBV and IFC co-organized the workshop on Technology-based Business Models in Support of Financial Inclusion in Vietnam. Participants attending the event include Secretary General of Vietnam Banks Association, former Deputy Governor of State Bank of Vietnam Nguyen Toan Thang, and 111 representatives from the Vietnam Government, Ministries, Central agencies and organizations, 22 MFIs, Diplomatic Corps, international and local Non-Governmental Organizations (NGO). The event also attracted numerous reporters from credible newspapers and TV channels.

The purposes of this workshop are (1) to promote Financial Inclusion (2) to provide updates on the current context and trends of technological applications in the financial services sector in Vietnam and (3) to create an environment for MFIs and Fintech companies to connect with each other for future cooperation.

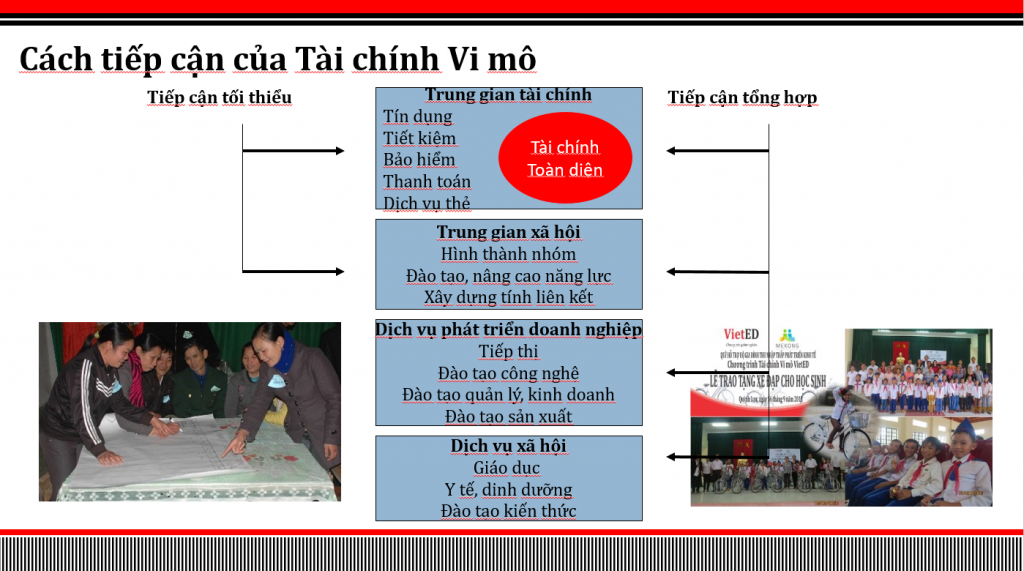

The workshop started with a thorough presentation from Ms. Le Phuong Lan – Deputy Director General of Banking Strategy Institute – State Bank of Vietnam on the role of Fintech in the journey from Microfinance to Financial Inclusion. In her presentation, Ms. Lan explained in great details why Microfinance is the starting point for Financial Inclusion and how to achieve Financial Inclusion from the current stage with the help of Fintech. After that, Mr. Ivan Mortimer-Schutts – IFC’s Regional Leader for Retail Payments and Mobile Banking in East Asia – presented the global trends and innovation in digital finance and their implications for Financial Inclusion. Based on that background, he then proposed some Business and strategy considerations for MFIs in Vietnam to benefit significantly from the ongoing trends. The last presentation was from Mr. Le Anh Dung – Head of Division – Payment System Department, State Bank of Vietnam (SBV). In his presentation, Mr. Dung mentioned not only the current situation, but also the challenges and barriers for Financial Inclusion in Vietnam and how they could be overcome with the growth of Fintech. Mr. Dung also provided some examples on how FIs have successfully applied Fintech in their operations and ended his presentation with his thoughts on the potential partnership between MFIs and Fintech companies in the future.

|

|

|

The workshop continued with a panel discussion of representatives from SBV, IFC, MFIs, Fintech companies and Research Group on the topic. The panelists all agreed that the digital breakthroughs would create numerous challenges for FIs in general and MFIs in particular. Mr. Le Anh Dung stated that there were 3 ways traditional FIs could take advantage of the ongoing trends: (1) improving their own system and staff with technologies; (2) forming partnership with Fintech companies and (3) acquiring Fintech companies. For MFIs, which have limited resources, network and infrastructure, he believed that forming partnership with Fintech is the best option for the future. As a representative of SBV, Mr. Dung emphasized that SBV had been aware of the digital payment trend since 2008 and allowed several organizations (not banks) to provide payment services in pilot projects. Based on the experience, SBV had built the legal framework for digital payment with Decree No. 101, Decree No. 30, Circular No. 39 on digital payment licensing. SBV also formed a Fintech team focusing on Digital Payment, Blockchain, Digital Identity, Open Banking, Open API etc.

Mr. Phan Cu Nhan, based on his research findings, expressed concerns that the traditional advantages of MFIs – being able to provide services to remote areas – might be lost due to the growth of Fintech solutions such as mobile payment, mobile savings etc. Under these circumstances, the potential partnership of MFIs and Fintech companies is essential. However, at the moment, most MFIs, despite being aware of the Fintech companies and services, had not reached out to them yet. On the other hand, Fintech companies had not considered MFIs their suitable partners yet due to their size, their current infrastructure and also their limited activities (for example, unlicensed MFIs are not allowed to take deposits). Mr. Nhan suggested that the small MFIs should consider merging into bigger MFIs in order to become more potential partners for Fintech companies.

The representatives of MFIs – Ms. Duong Thi Ngoc Linh, General Director of TYM MFI – and of Fintech companies – Mr. Tran Thanh Nam, CEO of MOCA – also believed that future partnership between the two parties would benefit both significantly. Ms. Linh shared that TYM had been aware of the Fintech trends and not only started building their Core banking system but also formed a team of IT specialists to explore and apply innovative technologies in their activities. TYM had also discussed potential partnership with Lien Viet Post Bank or Digital Wallet Momo.

On the other hand, Mr. Nam believed that Fintech companies can provide MFIs with less costly solutions than building their own system. According to him, Fintech companies could create numerous beneficial solutions for MFIs in the future, as they did with many other organizations and industries.

The panel discussion ended with questions about the legal framework, the potential partnership between MFIs and Fintech companies, showing the audience interest in the covered topics. Many participants really looked forward to the future partnership and expected SBV to facilitate it with suitable and timely policies & regulations.